At the heart of the national system of counteracting money laundering and the financing of terrorism is General Inspector of Financial Information (the GIFI). According to the Act of 16 November 2000 on counteracting money laundering and terrorism financingappointed and dismissed by the Prime Minister at the request of the minister competent for financial institutions. (OJ 2010, No. 46 item 276 with amendments), hereinafter the Act, the GIFI - ranked as an undersecretary of state in the Ministry of Finance - is

In the performance of its tasks the GIFI is supported by the Department of Financial Information of the Ministry of Finance, which acts as the Polish Financial Intelligence Unit (PFIU).

"Financial intelligence unit (hereinafter referred to as "FIU") means a central, national agency responsible for receiving (and, as permitted, requesting), analysing and disseminating to the competent authorities, disclosures of financial information:

i) concerning suspected proceeds and potential financing of terrorism, or

ii) required by national legislation or regulation,

in order to combat money laundering and financing of terrorism."

In accordance with Article 1 letter f) of the Council of Europe Convention on Laundering, Search, Seizure and Confiscation of the Proceeds from Crime and on the Financing of Terrorism (OJ 2008, No. 165 item 1028)

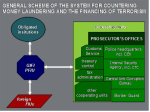

The system of combating money laundering and the financing of terrorism in Poland consists of:

- the GIFI,

- obligated institutions (inter alia credit and financial institutions, including banks, co-operative savings and credit unions, investment funds, investment fund associations, life insurance companies, factoring and leasing companies, payment institutions,legal professions - notaries public, lawyers and legal advisers, certified auditors and tax advisers, non-profit organizations – foundations, associations with corporate personality and receiving payments in cash of the total value equal to or exceeding the equivalent of 15.000 EURO, property values intermediaries – auction houses, exchange offices, pawnshops, second-hand shops, real estate agencies, Polish Post etc. The complete list of the obligated institutions is prescribed in Article 2 (1) of the Act),

- cooperating units (central administration and local government authorities and other state organizational units, also the National Bank of Poland, the Commission for Banking Supervision and Supreme Chamber of Control – Article 2 (8) of the Act).

Obligated institutions and cooperating units inform the Polish Financial Intelligence Unit about suspicious transactions or suspicious activity. The Polish FIU operating within the Ministry of Finance verifies the reported suspected cases of money laundering and financing of terrorism on the grounds of information gathered from obligated institutions, cooperating units, as well as foreign financial intelligence units. In case of justified suspicion of money laundering or terrorism financing it forwards it to the Prosecutor's Office which in cooperation with the law enforcement authorities undertakes actions aiming at completing the indictment against the suspects.

The Prosecutors' Offices and law enforcement authorities advise the GIFI on all cases of receipt of information indicating suspicion of crimes money laundering or terrorism financing committed, initiation and completion of proceedings on money laundering or terrorism financing crime, presentation of charges relating to those crimes (also when the proceedings were initiated on information from other resources than the GIFI/PFIU).

The authorized entities – mainly the Prosecutor's office and law enforcement agencies – use the Polish Financial Intelligence Unit's data about the transactions (gaining information rendering its written request or on the GIFi's own initiative).

By reason of the transnational dimension of money laundering and the financing of terrorism crimes the Polish FIU exchanges information with foreign financial intelligence units. The exchange is effected either on the basis of bilateral agreements concluded between the GIFI and its foreign counterparts or on the basis of the Council Decision 2000/642/JHA concerning arrangements for cooperation between financial intelligence units in respect of exchanging information (OJ L 271/4 of 24-10-2000, p. 4)

The effectiveness of the system is reinforced by the control of the performance of tasks resulting from the Act of 16 November 2000 on counteracting money laundering and terrorism financing. The control first of all consists of checking whether individual obligated institutions are adequately prepared to combat money laundering. It is exercised by the Polish Financial Intelligence Unit and other authorities supervising the obligated institutions.

Additionally, in order to improve the quality of the system and aiming to deliver new solutions, the Polish Financial Intelligence Unit actively participates in the works of international institutions and organizations, focused on combating money laundering and financing of terrorism:

- The Egmont Group of Financial Intelligence Units (The Egmont Group)

- The Committee for the Prevention of Money Laundering and Terrorist Financing and the EU-FIU Platform (both European Union bodies),

- MONEYVAL, The Council of Europe's Committee of experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism

- Financial Action Task Force – FATF (Poland participates indirectly as a member of the MONEYVAL Committee)

- Eurasian Group on combating money laundering and financing of terrorism (Poland has observer status)